“I’m in Boca”

“Risk” isn’t a term you would think needs to be defined, but in the investment world it’s imperative that you clarify what you mean when you talk about risk.

Professor Elroy Dimson of the London Business School famously said, “Risk means more things can happen than will happen,” which is a pretty good place to start. It sets the stage for any scenario where risk exists.

But for the businessperson or the individual investor, talking about risk usually comes down to the risk of losing money—that is, we’re worried about downside risk as opposed to upside risk.

But even that simplified definition leaves questions.

To start, what’s the time period you’re talking about? If I won’t need to cash in my investment for another twenty-five years, is it still risky if it’s down a month after I invest? How about a year? How about five years? Obviously, if I’m down in year twenty-four, I have something to worry about. But somewhere between day one and day 9,125, I have to have an investment that is at least earning me a positive return.

Positive return. Hmm. So if you invest $1,000 today, and you have $1,001 in ten years, is that a positive return? Would you be happy with that?

It depends!

If inflation has averaged 2 percent per year over those ten years, you have lost money. After accounting for inflation, you have lost purchasing power. You may have a positive nominal return of $1, but your real return is negative.

But if prices fell over ten years (that is, there was deflation), then you might just be happy with that $1 nominal return.

So, maybe risk is really about maintaining your purchasing power over time.

That’s a better definition, but we’re still not quite there yet.

The average investor would agree that they at least want to maintain their purchasing power, and so define risk as failing to achieve that. That’s at a minimum.

But if you’re invested in risky assets, such as stocks, you need to be doing better than that over time; otherwise, it’s hard to justify the risk you’re taking (and the risk in equities is that your holdings go to zero). This is called “risk adjusted return,” and it’s a critically important concept that most non-finance types have never really considered.

So, this all seems quite logical so far. If I’m going to invest, I want to get paid to assume risk. Risk is my partner in hitting home runs. It’s why I expect to earn a positive return from investing!

Now I want to go on a bit of a digression from finance theory to understand how it applies to your own specific situation. We said that we want to maintain purchasing power over time, but your purchasing basket doesn’t necessarily track the average inflation rate. So whether you’re saving for your kid’s education or a vacation home in the south of France, you want your assets to grow in such a way that you’re on the way to achieving your own targets.

It’s important to note, and I can’t state this enough, that your own targets have nothing to do with what the stock market averages are doing. Trying to keep up with a persistently buoyant market is a dangerous game to play if you don’t need those types of returns to achieve your goals.

Maybe we can then define risk as the possibility that you won’t reach your goals.

Yep, that’s it. That’s the definition of risk that really matters to you.

Now I’m going to tell you something that might surprise you.

The vast majority of money invested in the markets has a completely different definition of risk.

Instead, these large investors define risk as deviating from the returns generated by broad market benchmarks.

Wait… what?

So let me get this straight—if the market is down 10 percent next year, these investors define risk as not losing 10 percent next year?

Pretty much!

Institutional managers, who represent the vast majority of money invested in the stock market, obsess over metrics like “tracking error” (basically, how different your performance is from the broad market benchmark) and “information ratio” (an odd and silly measurement that is higher—and interpreted as better—the closer you can keep to the broad market’s performance).

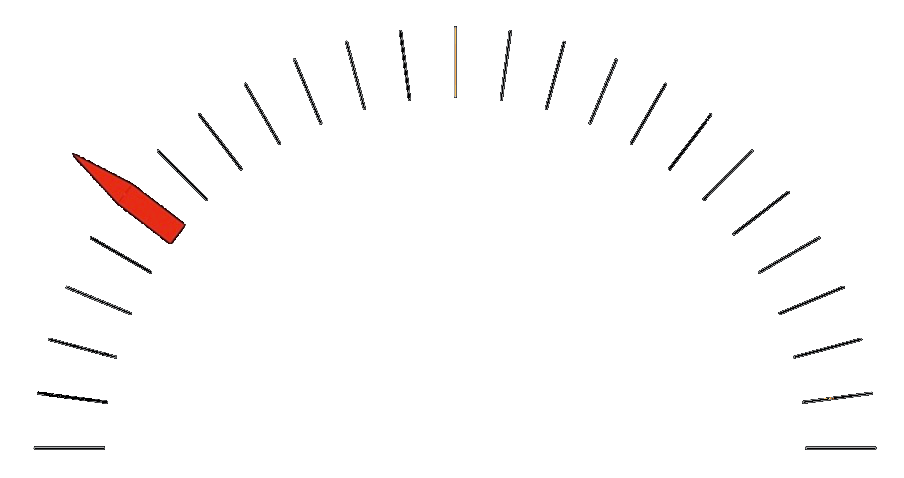

And on a practical basis, the guys actually managing the money define their own personal risk as the risk of getting fired. They don’t need to worry about protecting your money or preserving your purchasing power. They don’t know you and will never meet you. If the market is down 10 percent, they’ll get a pat on the back for only being down 8 percent. They just don’t want to be down 12 percent. And so low-risk investing to them is tracking the benchmark as closely as possible—but not going under. It’s like a bizarro version of The Price Is Right.

If you’re new to the market and confused after reading this, that’s good. It means you have common sense, and you haven’t yet been corrupted by academic finance theory. There is hope for you yet!

Academic finance looks at your stock portfolio and sees “asset class exposure” designed to earn an “equity risk premium” over time. It tells you to own as many different stocks as possible in order to eliminate “non-systematic risk” from your portfolio, leaving only “systematic risk” and giving you access to stock market “beta.”

Huh?

To academic finance, losing money isn’t “risk,” it’s part of the game. Instead, they see “risk” as not getting access to all that juicy “beta.”

This is, of course, nonsense.

When you talk about the risk to your savings, you’re talking about losing money. And, more accurately, you should be talking about losing purchasing power.

Financial writer Jason Zweig wrote a column for Money magazine way back in the go-go days of January 2000, when the market was soaring and it seemed that everyone was becoming a stock market millionaire. He interviewed dozens of residents of Boca Raton, Florida, asking if their portfolios had beaten the market. Some said yes, and some said no, but the most memorable quote he pulled for the article was from one man who said, “Who cares? All I know is, my investments earned enough for me to end up in Boca.”

Photo by Rafael Figueroa on Unsplash

And that pretty much sums it up. Why worry what everyone else is doing when you’re in Boca?

Once again, two groups who need to communicate, investors and money managers, are not speaking the same language. All this talk about “risk” is really just us talking over each other. Which is incredibly dangerous, because when all is said and done, the only thing you have control over when constructing your portfolio is your risk exposure.