Lies, false promises, and con men

Every bubble period in stocks is characterized by excess, and by those who use the opportunity to take advantage of the throngs of ordinary people who throw caution to the wind in an effort to get rich quick.

Recently, Chris Bloomstran took to Twitter to compile the case against “King of SPACs” and “next Warren Buffett” Chamath Palihapitiya. In particular, he looked at the lunacy of Chamath’s promotion of Virgin Galactic, which was just another one of many bubble stocks that has incinerated investor capital.

Click through and give it a read, Chris has done an excellent job of explaining how the pump and dump works. But my point here isn’t about Virgin Galactic or Chamath in particular, but rather a pattern that long-time financial industry observers are unfortunately well acquainted with.

You see, this guy got a lot of free publicity on CNBC. Like, a lot. Searching “Chamath” on CNBC.com gives you 461 hits, 143 of which are videos of his various network appearances. So here’s a guy who knows how to use media to his advantage.

So far, so typical. And ordinarily I’d not find it notable at all. Buyer beware and all that jazz. Bubbles inflate, then they pop. People lose money, learn their lessons, and we move on.

But what grates me most about the story isn’t how it’s turned out for Chamath’s victims investors, but how it was marketed to them in the first place.

In a Bloomberg sales pitch, the story he told is as follows:

It democratizes access to high-growth companies… because it allows retail investors *clears throat*… folks that have not necessarily been Tier 1 hedge funds, now they can also play.

He talked about full transparency, leveling the playing field for smaller investors. It was a lie, as Bloomstran’s thread clearly illustrates:

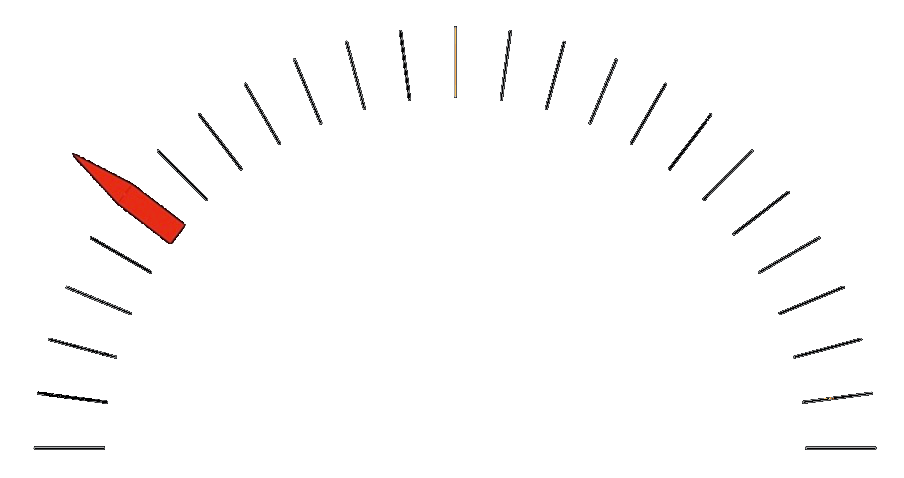

And so it ever will be. They talk about helping you get rich, but you are just a vehicle for their own enrichment.

This is not unique to Chamath or the recent SPAC craze. I can find examples in crypto (which is entirely unregulated), and frankly, in many of the prestige investments I write about in Low Risk Rules. They access time on financial media, they tell you what you want to hear, and they sell a product based on nothing more than hope, all while they cash out personally.

Having learned the lesson, don’t line up to be a pawn in their next game.