Don’t be afraid to invest in “Bad Ideas.”

Cathie Wood, celebrity fund manager of the boom and bust ARK Innovation ETF, is a devout Christian who possesses a religious fervor towards her high-growth, valuation and risk-management be damned approach to investing. The ARK Fund has received a lot of press in recent weeks as one of the worst investments of 2022. And yet, not too long ago, it was celebrated as a money-maker for the new era.

Wood would have been wise to recall Proverbs 16:18: “Pride goeth before destruction, and a haughty spirit before a fall.”

You see, in October 2020, just as the final leg up of the most recent stock market bubble kicked into high gear, Ark Investment Management decided it would be a great time to mock the traditional investment managers seemingly left in the dust by their revolutionary strategy of investing in “innovation.”

The commercial, titled “Bad Ideas” and thankfully preserved on YouTube (for now, at least), is a testament to what happens at the peak of market manias.

If you’ve read Low Risk Rules you know that Ark Innovation is the antithesis of my own preferred investment style. But it’s not just me. The ad grated on most investment professionals because it framed value-conscious managers as hopelessly behind the times.

“Many investors appear to be afraid of companies that offer newer, faster, cheaper, and creative products and services,” said the ad.

Afraid?! You don’t want to be one of those investors!

The video went on to deride managers “holding companies associated with the traditional world order” such as “traditional transportation, banking, bricks and mortar retail, and linear TV.”

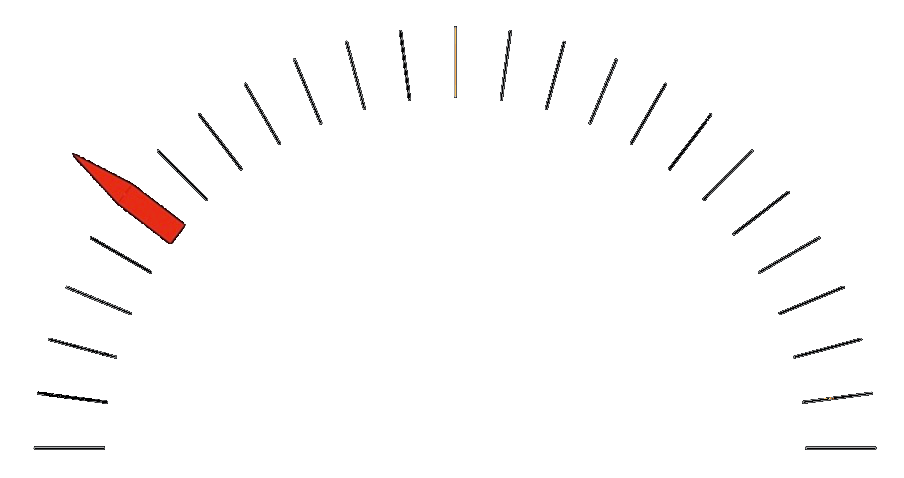

As the chart below shows, the Ark Innovation fund went on to gain almost 60% after the ad was published… only to collapse a year later.

If the ad inspired you to fire your scaredy-cat manager and jump on the hype train, you made a mistake. Investors chasing gains in this fund have, to put it charitably, lost a bit of money.

The issue with Ark was never the validity or promise of the companies it owned, but rather the valuation of those companies. Cathie Wood and her crew completely ignored traditional valuation measures. She and her proponents saw this as an advantage over the old school investors, but it was a fatal flaw.

The point here isn’t to run a victory lap, but rather to look back at what people were thinking when the growth mania was in full swing. Take this with you, as a form of inoculation against the next time people lose their collective minds chasing the next big thing, and tell you that “this time is different.”

The bottom line is that value matters. It always has, and it always will. There will be times when it falls out of favor, but like gravity, it always re-exerts itself on investment returns.

For the new year, this is a reminder to stay humble, and to be very careful which bandwagon you choose to jump onto. It might look very silly in a year or two.