Why we're bad at investing part 6: We seek excitement

On the opposite side of the loss averse, there are those who pursue risk for a thrill. Entrepreneurs often find themselves unconsciously chasing risk out of boredom—especially after a business sale.

A gastronomic example is the Japanese fugu fish, and I learned about it from the Simpsons.

I had to look it up. I was curious whether this fish, which in the TV show was supposedly improperly prepared and consumed by Homer, leaving him with only 24 hours to live, was an actual thing. Of course, truth is always stranger than fiction, and the fugu is indeed a Japanese delicacy.

It turns out that this Japanese blowfish’s organs contain tetrodotoxin, said to be 200 times more deadly than cyanide. The show’s writers did take artistic license, though. In the show, ingesting an improperly sliced fugu wouldn’t kill Homer for 24 hours, but in real life it actually results in a much quicker death through systemic paralysis and loss of bodily functions (which would have made for a much less entertaining episode).

With an abundance of safe and delicious fish to choose from, one would think that fugu would be thriving in their natural habitat, safe from the attention of throngs of sushi fanatics.

But you and I both know that’s not the case, and it has everything to do with the irrational human need to pursue a thrill.

You can pay hundreds of dollars for a small portion of fugu. That’s partly because the fish itself is rare and endangered. But it’s also because only certain chefs are able to prepare it safely, and they must train for years to obtain the necessary certification to do so. The chef’s final exam is to prepare and eat his own meal. How’s that for a professional with skin in the game!

So if you’re ordering fugu, you’re paying a lot of money for a tiny portion, with a nonzero chance that you will die promptly and unpleasantly. Why do people do it? Many reasons. The thrill. Bragging rights. Exclusivity. Some say that tiny remnants of the poison clinging to the flesh produce a unique tingling on the lips. I’ll just take their word for it.

No person thinking in strictly rational terms would order this meal, or attempt to eat it. But there’s an innate human instinct to pursue the thrill. Some of us eat fugu. Some of us skydive. Some of us bet it all on the spin of a roulette wheel. And some of us take tremendous risks with investment capital, even when we know it’s not the “smart” thing to do.

If you can’t avoid the seductive call of the fugu, or the high risk investment, at least make sure that you understand the psychological drive that is attracting you to it, and don’t confuse it with a more prudent approach. You can eat fugu once in your life to say you did it… but making it a staple in your diet is probably tempting fate.

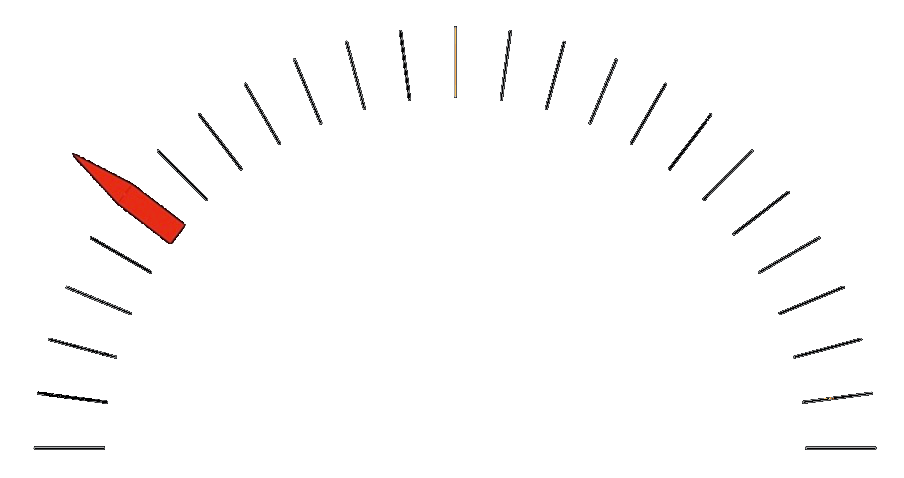

How to reconcile this innate desire to pursue a thrill with loss aversion? In the investing world it is an especially dangerous combination. There is a psychological urge to buy something only because it’s going up, or roll the dice on a lottery-type investment. Often this means you’re buying high and hoping to sell higher. And then, when the price turns against you, loss aversion kicks in and leads you to sell low.

I’ve found this play out especially with entrepreneurs, because they are not used to seeing their decisions “graded” by public markets so quickly and transparently. If I try out a new product line or service offering, it might take a few months before I know whether or not it’s a success, and I can course correct and tweak as we go, based on feedback. But if I make a speculative investment, I might be immediately burned by a decline in value, where loss aversion kicks in and prompts me to sell for a loss.

If you’re investing for a thrill, you’re doing it wrong.