You’re not Elon Musk

What follows is an outtake from Low Risk Rules: A Wealth Preservation Manifesto. Somewhere out there is a long-lost “Part One” that speaks directly to the entrepreneur after the sale of a business. This is one of those rough, lightly edited pieces.

I was going to name this section “you’re probably not Elon Musk,” but I gave it some thought and figured that for the 0.0001% of you out there who might potentially be the next Elon Musk, I would take the risk and leave out the extra word.

If you’re actually the next Elon, I apologize for the error. (And if you are Elon… hi Elon!)

Now for the other 99.9999% of you still reading this… you’re not the next Elon Musk.

Elon has repeatedly made huge bets with his net worth, risking ruin, and (so far), though a combination of luck and sheer force of will, has eluded disaster. In 2002, after the sale of PayPal to eBay, Elon netted an estimated $190 million, after tax. Not a bad payday. A mere mortal might have retired to their yacht, or at the very least set aside a large portion of this for their future security.

But we are not talking about a mere mortal.

Instead, Elon rolled the majority of these proceeds into three long-shot startups: Tesla, Solar City, and a literal moonshot - SpaceX - which was founded with the goal of going to Mars.

With hindsight we recognize Musk today as one of the world’s richest people. But success was never assured. Even after the huge PayPal payday, he found himself near ruin.

The following comes from Ashley Vance’s biography, Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic Future:

As 2008 came to an end, Musk had run out of money.

Riley began to see Musk’s life as a Shakespearean tragedy. Sometimes Musk would open up to her about the issues, and other times he retreated into himself. Riley spied on Musk while he read e-mail and watched him grimace as the bad news poured in. “You’d witness him having these conversations in his head,” she said. “It’s really hard to watch someone you love struggle like that.” Because of the long hours that he worked and his eating habits, Musk’s weight fluctuated wildly. Bags formed under his eyes, and his countenance started to resemble that of a shattered runner at the back end of an ultra-marathon. “He looked like death itself” Riley said. “I remember thinking this guy would have a heart attack and die. He seemed like a man on the brink.” In the middle of the night, Musk would have nightmares and yell out. “He was in physical pain” Riley said. “He would climb on me and start screaming while still asleep.” The couple had to start borrowing hundreds of thousands of dollars from Musk’s friend Skoll, and Riley’s parents offered to remortgage their house. Musk no longer flew his jet back and forth between Los Angeles and Silicon Valley. He took Southwest.

Burning through about $4 million a month, Tesla needed to close another major round of funding to get through 2008 and stay alive. Musk had to lean on friends just to try to make payroll from week to week, as he negotiated with investors. He sent impassioned pleas to anyone he could think of who might be able to spare some money. Bill Lee invested $2 million in Tesla, and Sergey Brin invested $500,000. “A bunch of Tesla employees wrote checks to keep the company going” said Diarmuid O’Connell, the vice president of business development at Tesla. “They turned into investments, but, at the time, it was twenty-five or fifty thousand dollars that you didn’t expect to see again. It just seemed like holy shit, this thing is going to crater”

To be clear, this sounds like a really horrible “retirement.”

The book goes on to detail the hoops Musk had to jump through in order to raise the necessary money and save his companies. It’s truly an incredible story, but also a cautionary tale of how close one man came to losing it all.

I understand the power of a positive attitude, and a belief that you can conquer anything that comes your way. I know that without a fierce belief in yourself that you can’t reach the heights you are climbing towards. I get that people have been telling you that “you can’t” your whole life, and you have been proving them wrong every step of the way.

Frankly, this is why I love working with entrepreneurs. I find the passion they have for their work to be energizing. There is almost nothing less interesting than the person who is ensconced in comfort, biding the days to retirement, happy with the status quo.

So I encourage you to go for it. But always remember how close Elon Musk came to ruin.

Over the course of my career I have known entrepreneurs who risked their big win following a successful exit, only to lose the majority of it. And many other professional advisors I’ve spoken with have just as many of these stories. In Low Risk Rules I talk about the other side of risk:

Over the years, many of my entrepreneurial friends and clients have openly rebelled at the idea of cashing in some of their chips after a liquidity event. If you feel this way, you’re not alone. It can almost seem like casting a vote of non-confidence against yourself.

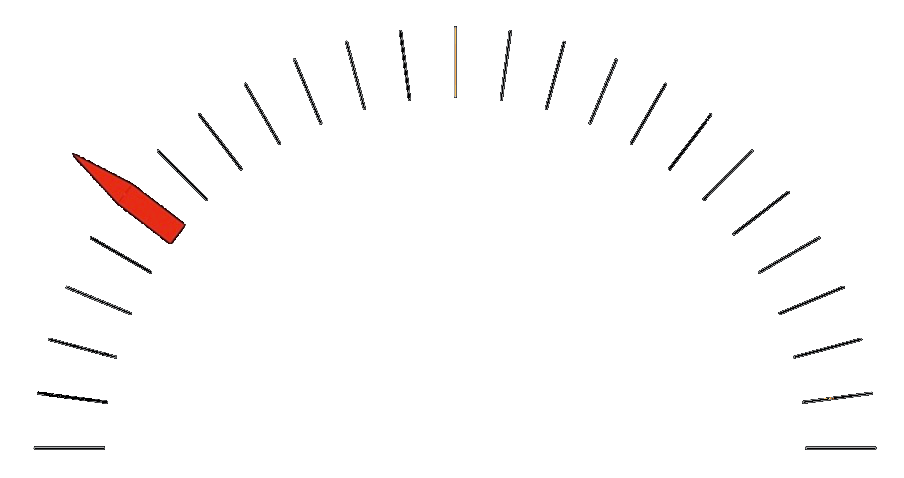

The dark side of risk is the entrepreneur who took on too much debt, the investor who doubled down on a losing investment, or even the degenerate gambler who insisted that “one more hand” would turn their luck around.

The temptation to keep gambling long after you’ve locked in a victory can cost you the security you’ve worked so hard to achieve. It seems far-fetched, but I’ve seen tremendous wealth vaporized by entrepreneurs who ignored the dark side of risk.

You’re probably not Elon Musk. You’re not going to successfully go from PayPal to SpaceX to Tesla, doubling down and making billions with everything you touch.

You’re probably going to have ups and downs. You’re probably going to want to make sure that your family is taken care of should the worst come to pass. And you’re going to want to balance that with that passion inside of you that’s driving you to make another thing that’s as amazing as the last thing you built and sold.

The message behind Low Risk Rules is that you can preserve and build wealth in a low risk way, and that doing so will give you the freedom to pursue your next chapter. And whether that involves relaxing days on a yacht or the next challenge you plan to conquer, the choice is yours.